Servicing Canada 24/7, 365 Days For Over 65 Years

Kernaghan Adjusters is an all-service independent adjusting firm; our adjusters provide expert risk management and claims services.

Property

Nationally our adjusters provide a high level of service in the area of property claims. We have the expertise on staff to investigate each loss to ensure coverage under the policy for a variety of insured perils. Clients can depend on us to provide a thorough and efficient investigation and quantification of the loss.

Commercial claims can range from complex agricultural, municipal, and manufacturing claims to simple retail stores. Personal Lines are one of our areas of expertise including high end residential claims, condominium/strata losses and mobile homes.

Our adjusters are trained in Xactimate, Contractor Connection, Code Blue and many are HAGG certified.

Property specialities:

Liability/Casualty

Commercial and personal lines are managed by our adjusting team across Canada. The investigative work required for the various liability / casualty lines is varied and challenging. We have a unique understanding of the requirements in this complex claims area. We focus on continuous training for our adjusters to ensure their standards are amongst the best in Canada.

Our expertise includes: commercial general liability, professional liability, municipal liability, products liability, course of construction, malpractice, ski hills and pollution. Our adjusters have access to our on-line legal case law service, which allows instant access to over 300,000 insurance-related court decisions.

Losses of a greater complexity or size are handled by our Major Loss Team.

Tasks

Kernaghan Adjusters provides Task Assignments services to our clients for a variety of loss types. We work with clients to develop specific Tasks for continuous use. As required by the client, we will also provide services for specific tasks at an agreed price. The following are a few basic Tasks as examples:

- Detailed Statements & Interviews: witness, character, family impact etc

- Scene investigation – with specific requirements

- Coverage & Liability Assessments

- Loss Quantification & Control

- Document / Evidence Gathering

- Property scope

- Scene Photographs

- Prepare and submit Contents list

- Skip Tracing

Auto

Auto claims are part of our standard service offering nationally. Auto claims whether for personal lines or fleet management are handled by our experts. Claims may include: bodily injury assessment, accident benefits assessments and settlements, fatal losses, vehicle property damage, impact to buildings and other property, spillage of pollutants and salvage disposals – including fleet accounts across Canada.

Long Haul Trucking Losses see Transportation Services.

Transportation

Our National Transportation Team is available 24/7 to provide expertise in Transportation Losses. Our experience, skills and fast response-time are critical to our service. We respond swiftly and effectively to the demands of transportation losses by immediately attending the accident scene, securing the scene, arranging environmental cleanup, securing spilled/damaged cargo and quantifying the loss.

Heavy Equipment

When working in the fields of excavation, landscaping, logging, road construction and oilfields, heavy equipment is necessary to complete the job. This specialized equipment is subject to damage by the nature of the industries in which they are used. Our expert heavy equipment and forestry adjusters are trained in appraisals and can identify the equipment and required repairs from their vast years of experience.

Aviation

We provide claims handling expertise for a large variety of private and commercial aviation losses throughout Canada and the United States. We respond 24/7 to all types of aviation losses to include: major hull damages, mid-air collision, hanger fire, passenger hazard, fatal injuries, and hanger-keepers liability.

Environmental

Environmental claims are complex and often involve complicated scientific, regulatory and medical information. Policy interpretation is key to this field of challenging claims. Environmental claims include: oil spills, storage tank leaks, dry cleaning chemical releases, landfill contamination and odor, laboratory waste, contaminated water, and water loss/mold claims. Tort claims where bodily injury or death are the result can include manmade chemicals such as benzene or natural substances such as lead, mold or asbestos.

Professional Liability

Professional Liability claims arise from errors or omissions as it relates to the policy wording. They include professionals from architects and engineers to insurance brokers, and adjusters. We provide diligent claims handling in situations of alleged negligence against professionals. There is an increased demand for coverage, driven by a more litigious attitude in society today.

Farm & Livestock

Farm and livestock claims are unique in nature. We provide expert service ranging from animals in transit, crop loss including pesticide damage, animal mortality/loss of livestock to business interruption. We work closely with veterinarians and farmers to ensure the proper care and attention is provided to these claims.

Construction

We have been relied on across Canada for our expertise in containing large projects with varying degrees of completion. Domestic and International markets have called upon our services to align with various specialists from concrete engineers to forensic accountants to establish cause and work quickly towards rebuilding.

Marine

Kernaghan Adjusters has a unique understanding of this special class of risk. Our adjusters understand that a rapid assessment of damages and prompt repairs are of the utmost importance.

We are skilled in providing marine surveys working closely with the client to ensure our services meets their needs. We provide cargo assessments to include: quantification of cargo losses, pre and post delivery inspections, damage assessments, load security and hazardous products management.

Major Losses

As a national firm, Kernaghan Adjusters has the expertise to handle large, diverse and complex losses across Canada. The quality of our adjusters reflects our commitment to provide the best service in this area. We have a designated Major Loss Team of adjusters with a wide range of experience in multifaceted liability and property claims.

A major part of our business model is the management of catastrophe claims for our clients. Kernaghan Adjusters has a fully licensed, trained and skilled team of CAT Adjusters available 24/7, 365 days a year nationally. The team is comprised of highly experienced adjusters able to respond to catastrophe situations promptly. Our team greatly contributes to KA’s reliability in this most unpredictable field.

Our objective is to exceed the needs and expectations of our clients and their policyholders during a catastrophe. We immediately deploy our CAT Team to ensure prompt service during high volume CATs.

Our CAT Services

- Hail

- Wind storm

- Snow storm

- Storm surge

- Frost

- Floods

- Ice

- Freezing rain

- Fire

- Tornado

- Hurricane

- Sewer backup

Our After Hour Service Commitment:

- Adjusters are on-call 24 hours, 7 days a week

- Adjusters provide 2 hour email acknowledgement

- Adjusters contact clients directly for large losses

- All emergency claims are attended immediately

- We deliver professional claims service

How it Works:

- Facilitated through our after hours monitoring center

- After hour calls patched live to an adjuster

- After hour emailed claims triaged by an adjuster

Service Process:

- 24 hour monitored claims email: claims@kernaghan.com

- Customized after hour client specific account procedures

- Pre-programmed call forwarding

- Call forwarding to our toll fee number: 1.800.387.5677

- Tailored after hours voicemail message

- Immediate contact with clients for emergency claims

- Redirecting non-claim related calls the following business day

Lloyd’s has served the Canadian insurance industry for nearly 200 years, and Kernaghan Adjusters has worked with Lloyd’s for over 65 years. Lloyd’s fully supports the coverholder model via the Canadian broker distribution network. Lloyd’s very proudly states “Our customers are the businesses and entrepreneurs who drive and serve the Canadian economy and they come to Lloyd’s to access the scale, diversity and financial strength of our specialist insurance and reinsurance market.”

Kernaghan Adjusters has worked closely with the Lloyd’s Market throughout our history. We have the adjuster expertise to service their claims arising from multiple classes of business such as heavy equipment, COC, Motor Carrier Cargo to TPA services. We are proud of our association with Lloyd’s. We deliver claims services to a diverse specialty market, 24 hours a day across Canada. We have a single point of contact for Lloyd’s claims service with first hand experience that understands the unique requirements of the Lloyd’s market.

Please email your inquires and claims to Lloyds@kernaghan.com

As Third Party Administrators we are able to serve as our clients’ claims department. We aggressively manage each claim from first notification to conclusion. We have extensive experience providing Control Adjuster Services to large national corporations. We provide clients with instant access to a professional claims department able to effectively administer portfolios of significant size. Regular bordereaux reports are a key element to the service we provide.

Kernaghan Adjusters works hard at understanding the needs of risk management clients. The field of risk management is about the decision‐making process for minimizing the adverse effects of accidental losses. Our focus is to determine a combination of techniques, at the front line, to assist in preventing and reducing losses and ultimately assist in the financial recovery of those losses if the need arises.

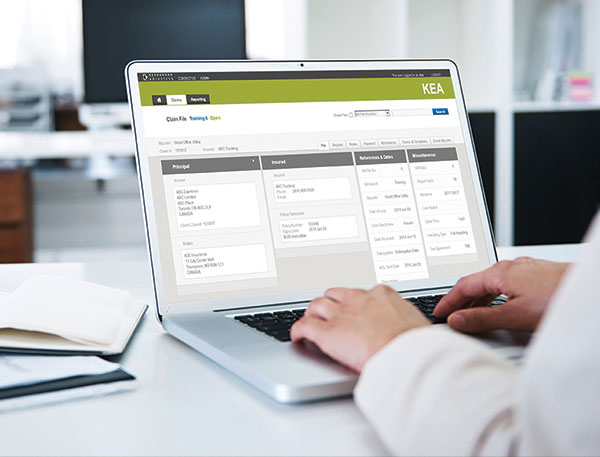

KEA – Kernaghan Electronic Adjusting

Web-Based Claims Management System

KEA is our enterprise wide web-based claims system. This secure innovative system provides our adjusters instant access to their claim files any time, any where.

KEA’s success is directly related to its intuitive functionality. Specifically designed for adjusters’ use, it is an enterprise-wide solution for the daily operating services of the corporation. KEA enables us to provide full communication with our clients, thus ensuring the successful resolution of critical claims activities. This leading-edge technology enables us to provide a higher volume of claims at a savings to our clients, while maintaining professional standards.

Our Managers and Adjusters monitor claims activity through KEA to include the following:

- New claim assignments are acknowledged within two (2) hours.

- Reserves and payments are reviewed throughout the life cycle of the claim.

- Claim reports are delivered in a timely manner.

- Cycle time adherence.

- File notes articulate the progress of the claim in detail.

- Quality control management reports.

KEA View

KEA View is our clients view into KA’s proprietary software. Clients access their file information to include: file notes, reports, photographs and claim financials with interactive e-mailing capability. KEA View facilitates an increased level of communication between clients and the adjuster.

Our security meets some of the highest standards in web application. It provides simplified management reporting for internal use and client convenience.